British Home Stores- how to lose £200million in 15 years.

The makings of a commercial empire?

British Home Stores (BHS) was founded in 1928 as a British department store, selling clothing, homeware and lighting products mostly for the UK retail market. BHS had very little growth following its merge with Mothercare and Habitat in 1986, which sought to diversify the brand and its products. However, in 2000, the department chain was bought by Sir Philip Green and was destined for integration into the Arcadia Group as a private company by 2009. The investment of £200million by Green was not unprecedented, given his previous ventures with retail companies Topshop and Burton. However, the Acacia group had built up a firm reputation for a revolving door of brands being integrated and later de-merged, a reputation which continued under Green’s control.

During the period of the early 2000’s, Green was set on building a group to challenge the largest of retailers, which was well on its way by 2002. During this time, Arcadia had become the 2nd largest clothes retailer, behind M&S. BHS employed 11,000 staff, with 163 UK stores alongside 74 international stores in 18 territories. These figures represent the scale BHS was trading at, however, their size was not proportionate to their wealth.

Failure, distrust and controversy

From 2010, just a decade after Green’s consortium had taken control, Arcadia faced a financial struggle, announcing a review of its portfolio. The conclusion of this led to the group closing high street stores from 2013 in smaller towns in order to counteract online shopping trends which were blamed for a fall in sales figures. Furthermore, the troubles of the consortium were also accredited to Philip Green himself, who became under pressure in 2010 for potential tax evasion and for the use of sweatshops within the UK. As time went on, the company failed to distance itself from scandal, Instead, Arcadia looked to expand their market share through new acquisitions such as a failed agreement with Marks & Spencer.

When BHS finally met its demise in April 2016, it had amassed £1.3bn alongside £571m of pension deficit. Mr Green came under scrutiny for the scale of failure BHS had endured over his 15 years of control, taking £586m of dividends. Such a large amount of debt valued the company at £1 in 2015, which was bought by Retail Acquisitions with the intention of turning things around. Unfortunately, this was not to be, and after just 4 months under new ownership, BHS went into liquidation after multiple failures to sell its property or make new profit. This was following inaccurate sales forecasts and figures that were produced by the business’s management that predicted a growth of sales without significant evidence.

The fall of the high street

So how did BHS loose £200 millions of value in 15 years? This is a question that can be answered by analysing the high street market itself, and how it has lost its appeal over the last decade. The fall of the High Streets can be traced back to the early 2000’s, when small businesses such as amazon began to gain popularity. Competition to BHS has also suffered a similar fate, such as Debenhams. The 242 year old business closed all 124 stores as of 2020, due to poor financial performance and a lack of desirable fashion items. However, in contrast to BHS, Debenhams transitioned online, which allowed it to operate another 4 years past BHS’s demise. Despite this, the products on offer changed infrequently and the brand became undesirable.

Internal weakness

Philip Green’s takeover can be argued as one of the first steps towards failure for BHS, as arguably, they worked for his advantage. The amount of Dividends paid to the Green family within the first 3 years was £60m of reserve cash, a figure that eventually rose to £586m when it was sold. Furthermore, the model of Arcadia and its owners failed to adapt to new market trends. The sudden growth of online retailing became an excuse for management rather than an opportunity, with rival stores such as Woolworths and HMV facing huge financial pressure. The failure to invest in a digital age would prove to be BHS’s downfall, closing without an internet presence until 2019 under new ownership.

Was BHS doomed from the start?

It is clear that BHS’s problems had been magnified in 2000 after its purchase by Philip Green, during a period that became pivotal for many businesses, with the emergence of the internet. However, in the 1990’s BHS was undergoing a transitional period of modernisation following a ‘facelift’. This strategy was proposed in 1995, involving a new logo style and modern branding that aimed at bringing in new customers before the new century. Despite the relatively low success, it is possible that this re- branding direction could have been continued to incorporate the growing demands of the internet and may have been successful.

However, this was not the case and as of 2013, stores began to shut, BHS’s competition was no longer other department stores, but other retailers selling similar products online. This emerging threat was never directly dealt with until April 2019 with new owners Litecraft Group Ltd. They began trading under The ‘BritishHomeStore’ license, entirely online. This new strategy for BHS operations has proved to bring success back to the brand, which aims to use its brand recognition to its advantage.

The Woking high street

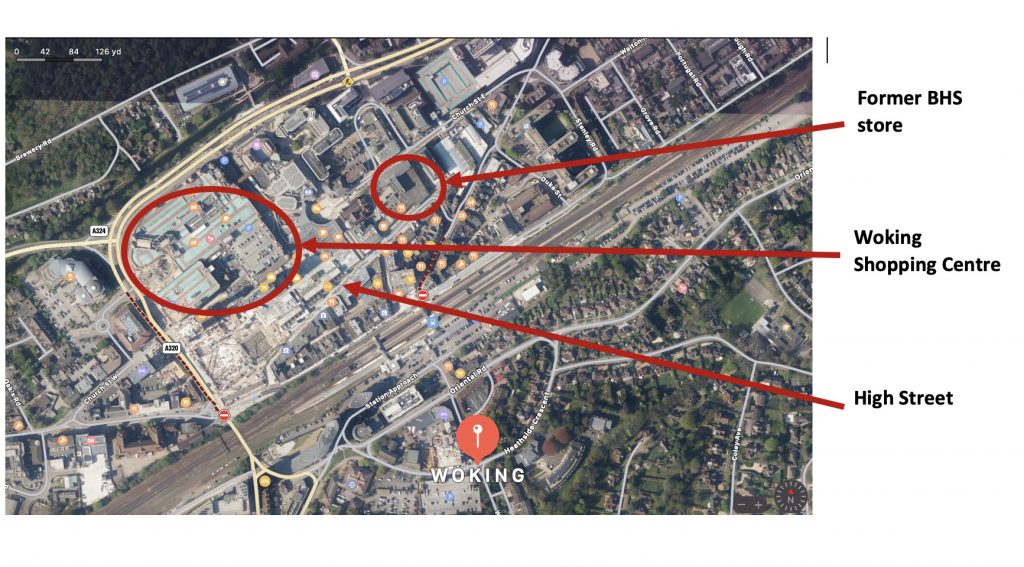

Woking Is an example of a town that followed BHS’s strategy for large central stores throughout its trading history. The location of the store became important for the business in 2013, when some stores faced closure. A decision was made by Arcadia to close stores on a high street, as to avoid the decrease of popularity they began to face. As a result, Woking remained open, in a town which boasted 250 retail businesses in 2017 and turnover of £110,507,000 in 2018. However, in the year following 2017, 5 businesses have left the area, with more set to follow over the coming years. Its closure allowed for new investment into the area by the British Heart Foundation who purchased the property just 3 months after its closure.

So what can we learn?

The underlying problems with BHS came in 2000 when Sir Philip Green purchased the business, a business that was already struggling to modernise and expand. Their financial problems were magnified in the years following, struggling to pay dividends and adapt to the ever changing market in which it operated. Poor financial management coincided with the growth of online shopping that has seen a decrease in high street demand and desirability. The business itself always had huge potential as a subsidiary of the 2nd largest retailer in 2002, though this was never built upon substantially, essentially adding to the list of failing department stores as trends change and competition comes in higher numbers.

Sources Used:

BBC: https://www.bbc.co.uk/news/business-37207481

Evening standard: https://www.standard.co.uk/business/sir-philip-green-bhs-arcadia-marks-and-spencer-topshop-metoo-b83016.html

Express: https://www.express.co.uk/news/uk/664161/BHS-Collapse-British-Home-Stores-History-Department-Store-Rise-Fall-Timeline

Retail Gazette: https://www.retailgazette.co.uk/blog/2017/09/bhs-online-sales-jump-35/

Surrey Live: https://www.getsurrey.co.uk/news/surrey-news/how-much-each-area-surrey-16264190